Amazon Pay today launched ‘Amazon Pay Later’, a service that will extend a virtual line of credit to eligible customers shopping on Amazon.in. With an easy digital sign-up process, customers will get access to instant credit that they can use to buy any product ranging from daily essentials to electronics and clothing items. Customers can also use this credit to complete their bill payments on Amazon.in. Amazon Pay Later service offers the option to repay in the subsequent month at no additional fees, or in easy EMIs up to 12 months at nominal interest rates.

Amazon Pay Later is a unique service that will help customers expand their access to credit and experience most convenient option of making payments.

This initiative by Amazon Pay is aimed at helping customers extend their budgets for purchases like home appliances, electronic gadgets, everyday essentials, groceries, and even pay their monthly bills be it electricity, mobile recharges, DTH etc. As a pilot, this unique service was available to a small set of customers and Amazon Pay has now extended this service to lakhs of eligible customers. Amazon Pay has partnered with Capital Float and The Karur Vysya Bank(KVB) to design and enable ‘Amazon Pay Later’ service for its eligible customers.

‘Amazon Pay Later’ offers a seamless payment experience with in-built security features and gives customers and option to setup auto-repayment to settle monthly bill or EMIs through the bank of their choice. Customers also have an option to repay all outstanding amount in one go at no additional fees. Based on usage and repayment behavior customers will also be able to enhance their credit limit further.

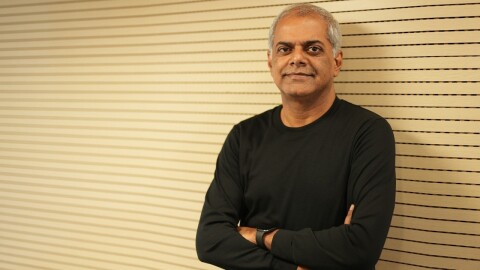

“We are always looking for ways to improve our customers’ payments experience on Amazon.in and make purchases more affordable. Amazon Pay Later is a unique service that will help customers expand their access to credit and experience most convenient option of making payments. In current times Amazon Pay later empowers our customers to better manage their monthly spends,” said Mahendra Nerurkar, CEO Amazon Pay India.

Why choose Amazon Pay Later?

- Customer can share their PAN card number and Aadhar card number and register in 3 simple steps

- You can pay next month at 0% interest or pay in 3 to 12 month EMIs. There are no hidden charges

- You don't need a credit card

- You can avail of credit upto INR 20,000

- You can set up an automatic repayment schedule

Know more about how to register and key benefits by clicking here